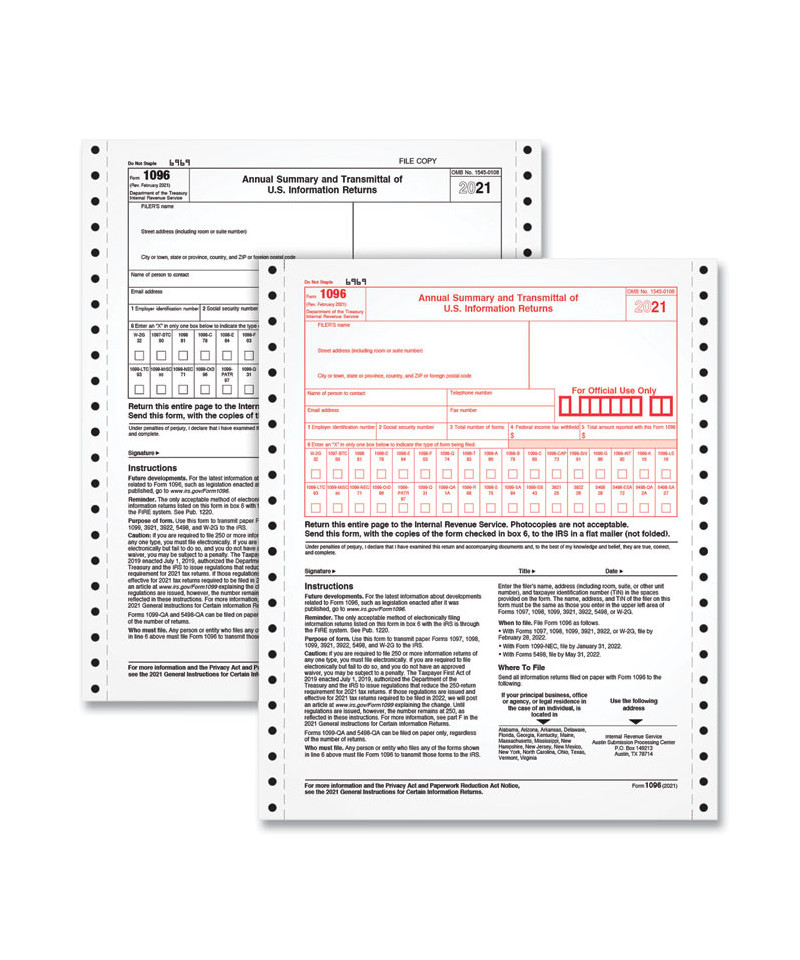

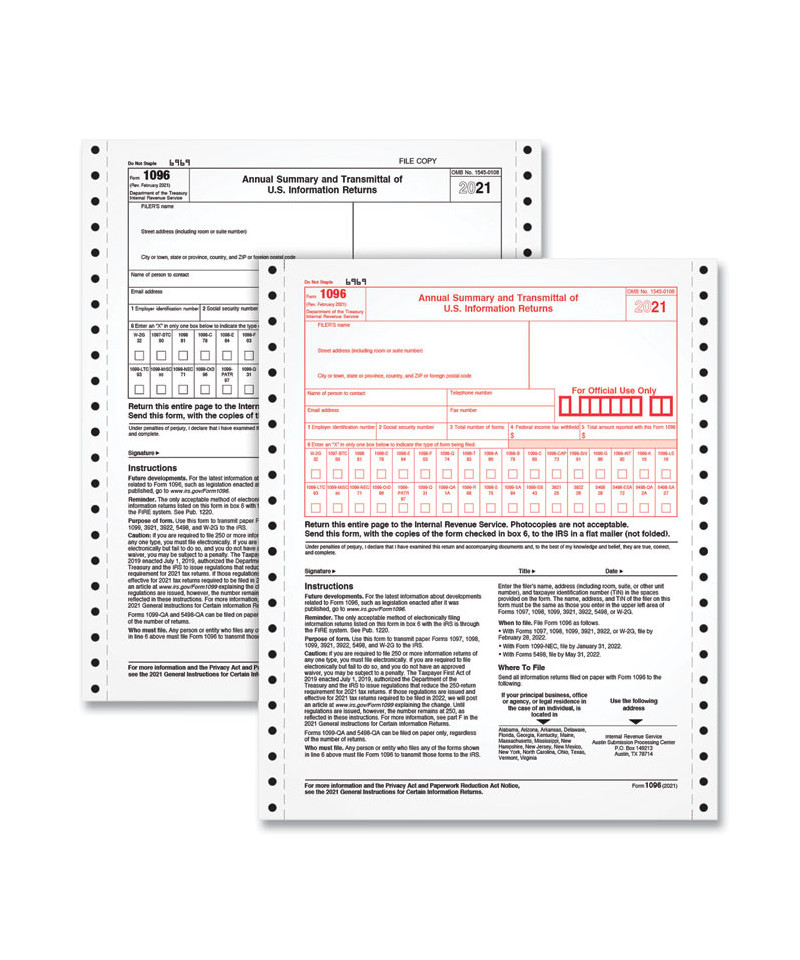

TOPS™ 1096 Summary Forms transmit the totals for select information returns to the IRS. You'll use the 1096 to summarize your 1097, 1098, 1099, 3921, 3922, 5498 and W-2G forms. You'll need a separate 1096 for each type of form you file. Our acid-free paper and heat-resistant inks help you produce smudge-free, archival-safe tax forms. Forms have the scannable red ink required by the IRS for paper filing and meet IRS specifications. QuickBooks and accounting software compatible.